There is anxiety about pension funds in the United States. A 2011 study by the Congressional Research Service pegged the combined liabilities faced by state and local pension funds at over $3 trillion.

One fund, CalPER (California Public Employees’ Retirement System), manages $230 billion. The fund now calculates that it is underfunded by $80 billion. The management arrives at this number by assuming they will make 7.5% on their investments. Joe Nation, a public finance expert at Stanford University, estimated that CalPERS’s long-term pension debt is a $170 billion if CalPERS achieves an average annual investment return of 6.2 percent in years to come. If the return is just 4.5 percent annually – a rate close to what more conservative private pensions often shoot for – the fund’s long-term liability rises to $290 billion. CalPER ranks in the bottom 1% of all pension fund managers. In the bull market of the last year, CalPERS made a 1% return to June 2012.

Just imagine how unions make investment decisions.

This is bad stuff. And the taxpayers will be on the hook to make up the shortfalls.

This is bad stuff. And the taxpayers will be on the hook to make up the shortfalls.

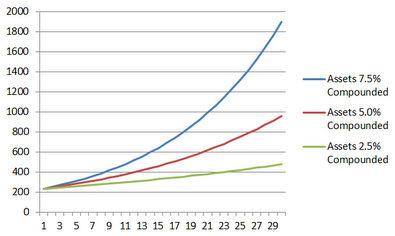

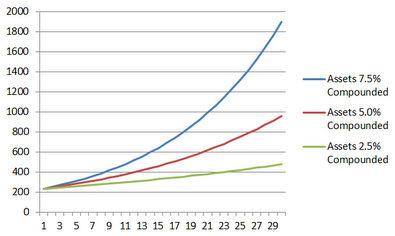

Here is a simple but interesting graph showing what happens to assets at different returns.

No comments:

Post a Comment