Funding Benefits

If a guy like Tim Murphy designed the Social Security system or Medicare, would you trust it to work well? Dennis Hastert? How about William Jefferson? Mark Foley?

An old statute requires the Treasury to issue an annual financial statement, similar to a corporation’s annual report. The 2016 edition is 274 pages.

It contains a table on page 63 that reveals the net present value of the US government’s 75-year future liability for Social Security and Medicare. That amount exceeds the net present value of the tax revenue designated to pay those benefits by $46.7 trillion. Yes, trillions.

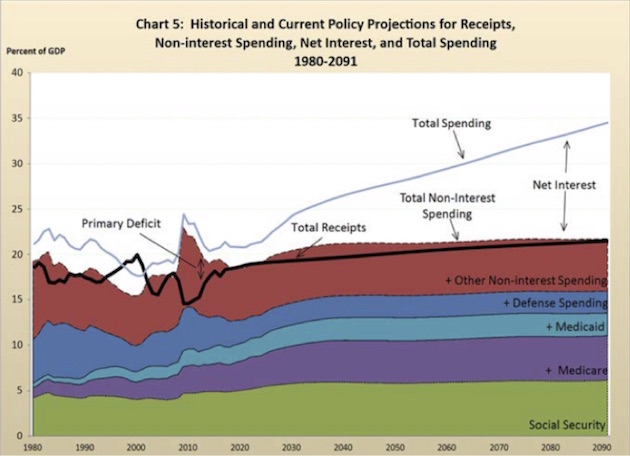

Note that this chart expresses the various items as percentages of

GDP, not dollars. So the relatively flat spending categories simply mean

they are forecasted to grow in line with the economy, or just a little

faster. But the space representing net interest

grows much faster than GDP does – fast enough to make total federal

spending add up to one-third of GDP by 2090.

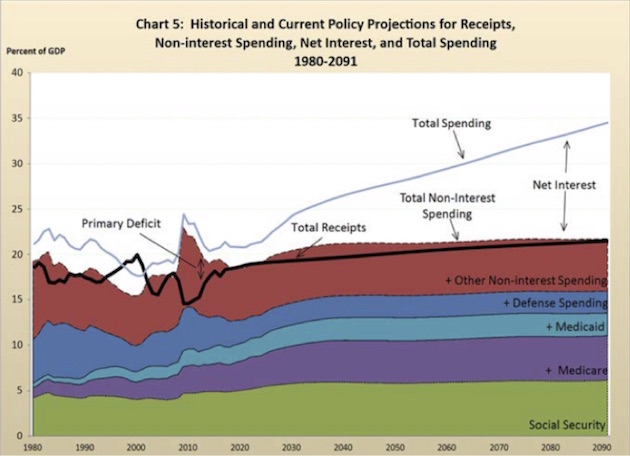

Note that this chart expresses the various items as percentages of

GDP, not dollars. So the relatively flat spending categories simply mean

they are forecasted to grow in line with the economy, or just a little

faster. But the space representing net interest

grows much faster than GDP does – fast enough to make total federal

spending add up to one-third of GDP by 2090.

This must, at some point, must be reconciled. How?

First, the benefits must be reduced. Initially it will be done righteously: "You earn too much to get benefits too." Then more generally. The essence will be a decline in living standards as those promises--and taxes that were committed to them--are slowly denied.

Second, taxes will go up. This will make less money available to people to spend and invest. That will create ....as above..."a decline in living standards as those promises--and taxes that were committed to them--are slowly denied."

If a guy like Tim Murphy designed the Social Security system or Medicare, would you trust it to work well? Dennis Hastert? How about William Jefferson? Mark Foley?

An old statute requires the Treasury to issue an annual financial statement, similar to a corporation’s annual report. The 2016 edition is 274 pages.

It contains a table on page 63 that reveals the net present value of the US government’s 75-year future liability for Social Security and Medicare. That amount exceeds the net present value of the tax revenue designated to pay those benefits by $46.7 trillion. Yes, trillions.

This must, at some point, must be reconciled. How?

First, the benefits must be reduced. Initially it will be done righteously: "You earn too much to get benefits too." Then more generally. The essence will be a decline in living standards as those promises--and taxes that were committed to them--are slowly denied.

Second, taxes will go up. This will make less money available to people to spend and invest. That will create ....as above..."a decline in living standards as those promises--and taxes that were committed to them--are slowly denied."

No comments:

Post a Comment