Graphs

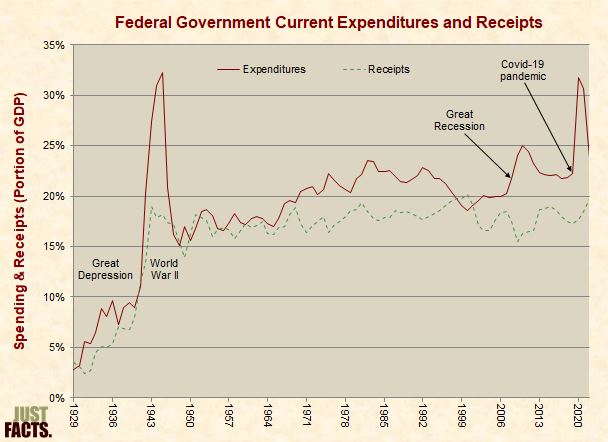

[Government] spending rates would be lower if all programs were required to be tax-financed. Government, however, may have access to both debt issue and money creation as alternative revenue sources. These allow the government to spend without taxing, which is almost the ideal setting for elected politicians. By creating deficits, the government is allowed to finance desired programs that provide benefits to potential voters without overt increases in rates of tax.

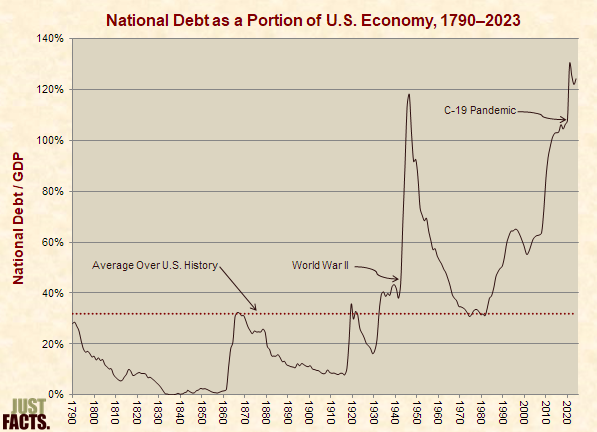

At the close of July 2020, the national debt was 126% of the nation’s annual economic output, or 4.2 times its average over U.S. history:

From 1929 to 2019, federal government current expenditures and receipts—expressed as a portion of gross domestic product—have varied as follows:

No comments:

Post a Comment