Crestmont does some interesting data collections. Here are two similar

topics with different formats. The question is, with the known long term

biases toward stock investment over the long term as championed by

Jeremy Siegel, how do stocks do in the shorter run, like for retirement

plans?

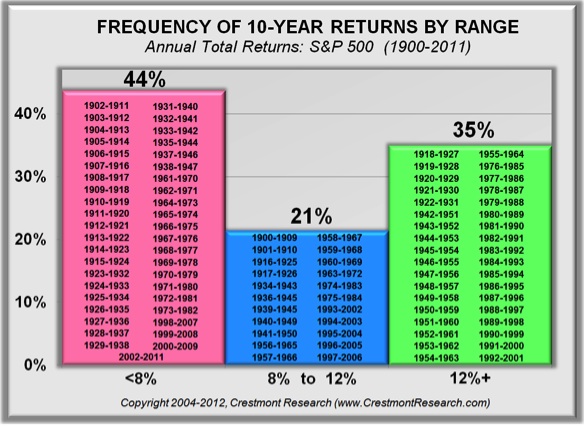

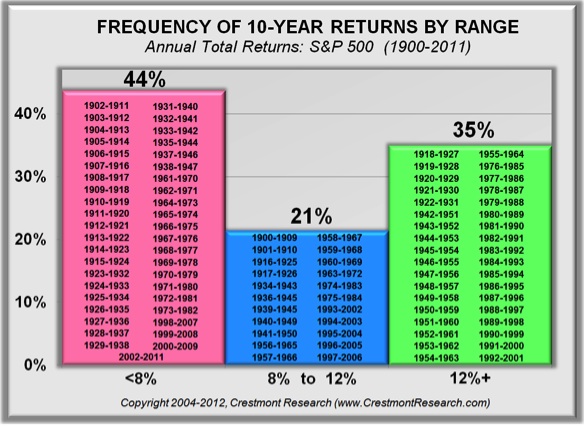

Here they evaluate ten year segments--annual returns over every ten year period since 1900. These are daunting. Look just at the period from 1900 to 1912. If you bought in 1900 or 1901, your returns would have averaged over 21% for ten years. But buying one or two years later and your return is less than 8%.

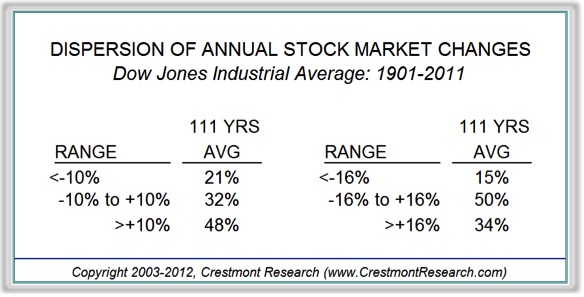

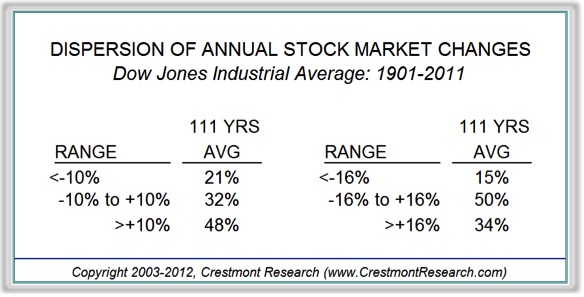

And groups of annual returns over the same period. 21% of years lost more than 10%, and 32% ranged from a 10% loss to a 10% gain. Dangerous if you are not in for the long haul.

Here they evaluate ten year segments--annual returns over every ten year period since 1900. These are daunting. Look just at the period from 1900 to 1912. If you bought in 1900 or 1901, your returns would have averaged over 21% for ten years. But buying one or two years later and your return is less than 8%.

And groups of annual returns over the same period. 21% of years lost more than 10%, and 32% ranged from a 10% loss to a 10% gain. Dangerous if you are not in for the long haul.

No comments:

Post a Comment